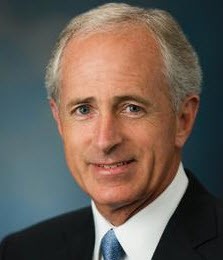

Corker said on “This Week” that he plans to introduce a “claw-back” provision which would take away the personal earnings for the past five years of the corporate officers of failed institutions that fall under the government’s resolution authority. Corker said, “if a large entity like this has to go through this resolution where in essence they’re liquidated in an orderly way, I think that everything that the executive team and the board members have earned through this company over the last five years needs to be clawed back. In other words, there needs to be some penalties assessed to the management that have caused the country to have to go through this orderly liquidation process.”

Now this a Republican good idea on financial reform that the President, who has said repeatedly he is open to good ideas from Republicans, should adopt. What has made the Sarbanes-Oxley so effective is that CEOs and the Boards now have to testify that they endorse all the financial details in each quarterly statement. This huge legal liability has largely prevented egregious financial statements as happened in the Enron and other accounting fraud cases that occurred in the late 1990’s. Can you imagine what financial institutions CEOs and Boards would do if they knew they could not escape Scott Free as they have currently done? But the bill should be broadened to include FDIC failures and any financial institution that gets capital infusions like the TARP funds provided because the current Regulatory Reform just does not eliminate the chances of another bailout being needed. The problem is that the current “too big to fail” banks are bigger than ever and have not changed their gambling ethos. Now, with the top dogs on the line for “Claw-Backs” in the millions – I suspect the gambling ethos would rapidly disappear.