Well Wall Street has spoken and they are demanding and betting big time as seen in the 3% rise in the DJIA today that Federal Reserve Chairman Ben Bernanke will be “printing money”. He did it last year just before the midterm elections with an annnoucement at Jackson Hole Wyoming financial conference in August trying to stimulate the US Economy. Now every financial website that comments on QE-Quantitative Easing warns to distinguish between “printing money” and QE-Quantitative Easing. The distinction is imaginative.

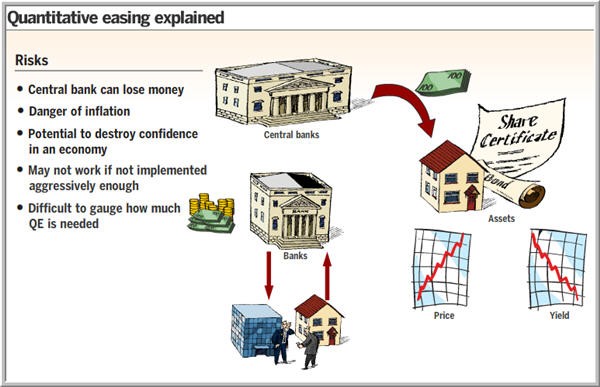

When the Fed prints money [increases the money supply] it does so through many financial institutions. When the Fed engages in QE-Quantitative Easing the money supply is also increased but it is targeted through buying of financial assets from selected financial institutions, corporations and government agencies. This “targetting of who gets the cash” is what distinguishes QE. The following presentation at the Financial Times describes in more details how QE is targeted, when QE is done and what are its risks. Pay attention because the risks are summarized in zingy one liners[you are assumed to know the causes and consequences in detail].

What QE Has Been Done So Far

An excellent summary of QE in Wikipedia tells what has been done so far and how:

The US Federal Reserve held between $700 billion and $800 billion of Treasury notes on its balance sheet before the recession. In late November 2008, the Fed started buying $600 billion in Mortgage-backed securities (MBS).[44] By March 2009, it held $1.75 trillion of bank debt, MBS, and Treasury notes, and reached a peak of $2.1 trillion in June 2010. Further purchases were halted as the economy had started to improve, but resumed in August 2010 when the Fed decided the economy wasn’t growing robustly. After the halt in June holdings started falling naturally as debt matured and were projected to fall to $1.7 trillion by 2012. The Fed’s revised goal became to keep holdings at the $2.054 trillion level. To maintain that level, the Fed bought $30 billion in 2-10 year Treasury notes a month. In November 2010, the Fed announced a second round of quantitative easing, or “QE2”, buying $600 billion of Treasury securities by the end of the third quarter of 2011.[45][46]

Now the QE1 amounts and targets were done for the big banks which had bought toxic assets. This was an addditional nearly $1.5trillion effort to help the TBTFs – the Too Big To Fail banks[the Big banks reward to the Fed paid back their capital loans, raised salaries, dividends, but not mortgage compromises nor loans to small businesses]. QE2 again targeted banks and financial institutions heavily invested in US long term debt to keep interest rates from rising. And who knows what and who will be targeted in the third round of Quantitative Easing. And also the amount to be spent. The whole problem is Governor Rick Perry from Texas and his GOP collaborators.

Rick Perry:QE3 as Treason

Republican Governor Perry has described QE3 as treason – and ye Editor finds himself agreeing, in part, with Perry. The crucial parts are how much and where will be the QE3 monies be targeted. The Nope-a-Dope Republicans in Congress have precluded any possibility of a stimulus passing , especially in the GOP controlled House. This is too bad because the best way to apply a stimulus to the economy would be very carefully targeted Congressional approved spending like tax relief for businesses that created new jobs in the US. Or allowance for offshore profits[currently amounting to $1.5trillion] to be invested in job creation programs or new additional innovation and capital spending in the US at discounted tax rates for those business investment in domestic jobs and industry.

But the GOP wants to destroy Obama by destroying the economy for 12-16 more months so that they can get a Republican elected President. So no, Nope, NYET is the GOP sentiment of the past 2 years and ongoing. And since Rick Perry is hankering for the job,of president – any QE3 stimulus is “treasonous” . Because if a QE3 works, then Perry is politically dead. However, the consensus of opinion on the Left and Right is that the US and European Economies are headed for a double dip recession if no stimulus for growth is applied. Hence the non-elected Fed Reserve is the last hope for avoiding a second recession.

But Perry may get his wish – QE3 depending on its targeting, may not work .

The consensus judgement is that QE1 despite its $1.5trillion bill did not work because the banks did not increase loans to small busineses nor take any actions to reduce costly foreclosures[in fact they did the opposite] and the mountain of underwater mortgages. The not so consensus judgement is that QE2 got the economy, job growth and the stock markets growing after mid Summer 2010 looked like midsummer 2009 and now 2011 – US and European economies teetering on a second recession. So what can Ben Bernanke do this time?

Bernanke Options

The obvious is a repeat QE2 – call it QE2.5 and for roughly the same amount of money and targeted at US mid level bonds and thus big banks. As noted this sort of worked. But likely will not work a third time because banks will hoard the money for repairing their deteriorating balance sheets. Can Ben target specific industries and projects? Yes. Investment in state and local government infrastructure projects which create jobs and local taxes. Or support clean energy start-ups or investments in the Medical information system pilot projects which already have funding but need business+government cooperative financing. And so forth.

But does this sound like the Fed doing the work of a dysfunctional Congress? Yes indeed it is . So expect lots of flack from the Nope-a-Dopers on the right. Will he do so and at what amounts? Not likely and too little – ye Editor is betting on QE2.5-like money levels and targeting designed to rescue the now too big to fail banks and associated stock market players. And still the GOP will complain. Have a glass of the finest Fifth ye Editor has to offer and await the Friday pronouncement.