Tom Wolfe’s book Radical Chic & Mau-Mauing the Flak Catchers is about PR and Spokespersons who seemingly can turn any criticism to the advantage of their client. But “flak catcher” had a second nuanced meaning – those who bore the brunt of public scorn diverting attention away from client and upon themselves. As well, attention was diverted from other 3rd parties who perhaps deserved the same or even greater scorn. Its this second meaning of Flak Catcher being used here.

Bankers are now known as Banksters. And why not ? The public pours scorn and disapproval on the banking community for its Too Big To Fail

ability to pass huge spending obligations onto the Public, Too Big To Jail immunity of its top executives from criminal prosecutions for major malfeasance during and after the 2007-2009 Great Recession, and Too Big To Manage failings of top managers who nonetheless reap huge multimillion dollar compensation including staggering golden parachute sums no matter how badly or indifferently they perform. But in the process of devoting so much attention and wrath on major Too Big Too Fail Banks and other Financial Institutions and their executive and financial trading elites => the Flak Catchers; another group that has performed equally dismally has escaped scrutiny – US public corporations and their top executives and board of directors.First, many non-banking public corporations took out major chunks of Federal Reserve bailout money in 2008 to 2010 saving themselves large financing costs or even the danger of bankruptcy to a total of $1.1 trillion. And these are major corporations like General Electric, Toyota, Caterpillar and others. Caterpillar, for example, has rewarded the public for its bailout funds with harsh anti-union activities.

Second, public corporations are playing hardball with Federal, State and local governments over keeping or opening up plants in their areas. The NYTimes has documented how major bailout beneficiary GM did and continues to do such hard bargaining for reduced taxes in a trade for jobs. The report details how broad these efforts are:

A NYTimes investigation has examined and tallied thousands of local incentives granted nationwide and has found that states, counties and cities are giving up more than $80 billion each year to companies. The beneficiaries come from virtually every corner of the corporate world, encompassing oil and coal conglomerates, technology and entertainment companies, banks and big-box retail chains.

The cost of the awards is certainly far higher. A full accounting, The Times discovered, is not possible because the incentives are granted by thousands of government agencies and officials, and many do not know the value of all their awards. Nor do they know if the money was worth it because they rarely track how many jobs are created. Even where officials do track incentives, they acknowledge that it is impossible to know whether the jobs would have been created without the aid.

So in effect corporations are truly taking advantage of being “Job Creators” no matter that they may be only doing “some job preservation” and at lower pay and benefits. In a country that heretofore has thrived on a large middle class with 70%++ of the economy dependent on Consumer Consumption, this a brazen Raiding of the Commons if not killing theConsumer Goose that produces the Golden Eggs of continued Economic Prosperity.

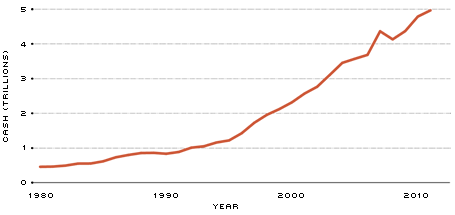

Third and most damning is seen in the following chart:

US Corporations are sitting on $5trillion in cash and short term investments.

More than half the money is lodged overseas because companies are insisting on another tax holiday despite the fact that the last one in 2004 under George Bush was a major bust. In addition, corporations are demanding less regulation [think lowered FDA, EPA, and other Federal standards] and more certainty which appears to translate into more Federal guarantees and favorable terms in all of their areas of operation. As a result,it is no wonder that a sizable chunk of US Corporations are bad for US Economy in general. More telling, it not a wonder that Chinese, Brazilian, Indian, Korean and European firms are now out innovating their American counterparts. Think Samsung over Apple and Motorola in mobile markets; Acer, Asus, and Lenovo over Dell and HP; and Smith Klein and Novartis over Merck and Pfizer for just a few examples.

In sum, the Too Big To Fail Banks have swept attention away from the the Too Complacent To Compete US Corporations. The Banks have become Flak Catchers for Corporate America distracting attention from the US Corporations extravagant compensation practices and Gilded Age rules of governance. So this raises the question – how long can major Corporations rely on the Banks as Flak-catching cover?