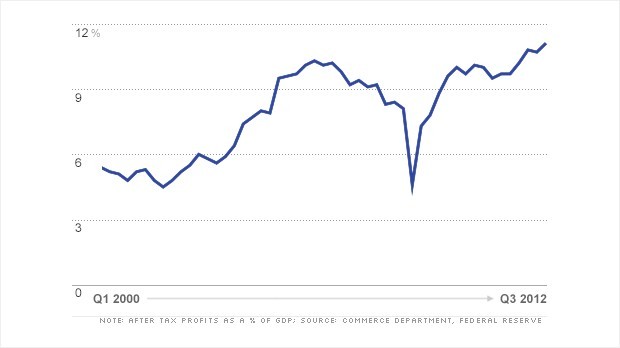

The US Job Creators are doing critical things very right by many Business standards. First and foremost, US Job Creators are making big , yes record profits. As seen in this chart for 2012. US Job Creators profits reached a new record level as a 11.3% of the total output of the economy:

US Corporate Profits in 2012 as a Percentage of Total US GDP

Business After-tax Profits as a % of Total US GDP are at a new record level nearly 11% of GDP

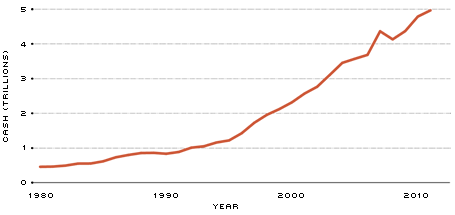

These record profits will add to to the over $5Trillion in the US Business Cash Hoard. But there is a problem – more than half of the $5-6 Trillion in cash is lodged overseas because companies are insisting on another tax holiday despite the fact that the last one in 2004 under George Bush was a major bust. As seen below, this is part of the US Job Creators trickle down and wait for a more rewarding business climate.

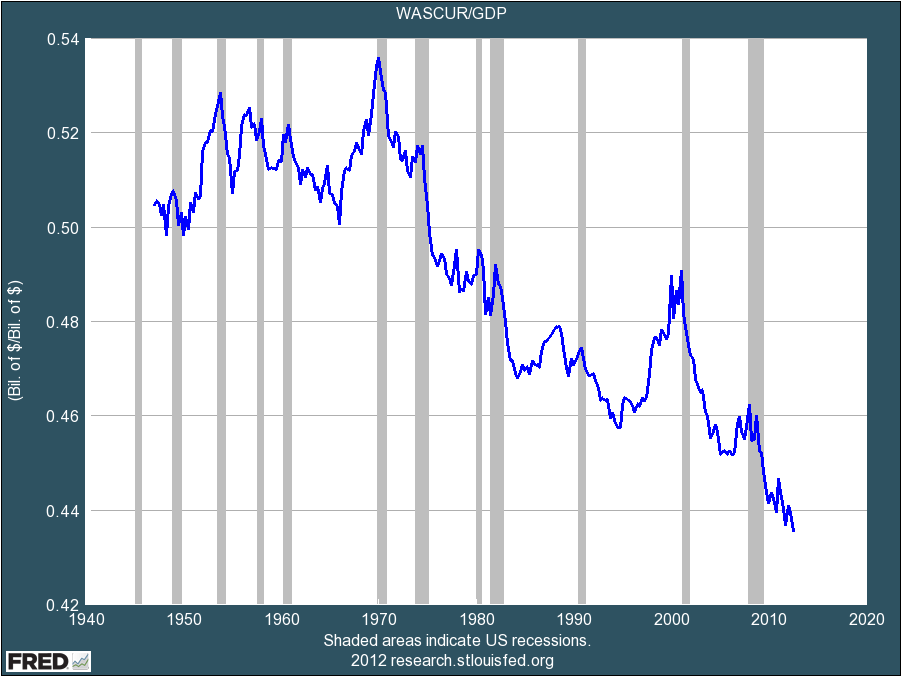

Meanwhile US Job Creators are reducing their costs significantly. Profit margins are up and wages costs are down as seen here:

US Wages as a % of GDP reached a new low, 44% in 2012

One of the fundamental problems in the US Economy is the fact that wages and benefits have reached historic low levels. But the US Economy depends on good wages to drive its growth – 70% of the GDP is ordinary consumer consumption.

However, there is good news for Job Creators – their own Top Executive total compensation have started to recover very nicely. Here are the trends:

Forbes 100 top CEOs’ Trend in Total Compensation for past 25 years

Total compensation has not yet reached the halcyon heights of 2007, just before the recession; but there is a steady uptick to $10.5 million per CEO.

The trend in CEO compensation as a multiple of average worker pay has also begun to turn around reachING 325 to 1 IN 2010.

Top Job Creator compensation has not reached it 2005 high of 411 to 1 but it is climbing up again.

And of course declines in workers take home pay has helped immeasurably to restore the Job Creator’s compensation advantage.

US Job Creators are waiting for the Best Possible Business Climate

Despite unprecedented government financial aid to their businesses, US Job Creators still demur on making big investments in the US. True they have the cheapest cost of capital in 20 years at 5.2%; but their maxim is – “when there is no opportunity to invest safely – stay on the sidelines”. Fortunately, that approach is starting to change.

And the US Job Creators capital investment is starting an upward trend.

But as noted above US Job Creators are sitting on cash hoards that are reaching truly astonishing levels of nearly $5 Trillion in 2010 and sure to be reaching near the $6Trillion level with growing profits again this year. Apple alone has $125 Billion in cash and short term investments and has been sued by hedge fund investor David Einhorn for not investing or paying out that cash as dividends. In sum, the US Job Creators certainly are not short of cash, have the lowest cost of debt capital and hardly appear to need the tax cuts that the GOP is working so assiduously to provide to them.

US Job Creators Cash Hoard Levels to 2010

Multi-Trillion Cash Hoard shows only a small downturn due to the 2007-2009 Great Recession

The US Job Creators can thank the Federal Reserve for keeping the slide in cash to a minimum as non-bank corporations dipped into public TARP funds for nearly $1.1 Trillion. And these are major Job Creators like like General Electric, Toyota, Caterpillar and others. Caterpillar, in return, has rewarded the public for its bailout help with harsh anti-union activities.

Job Creators are are so insistent on the need to hoard cash that they are bargaining tough with Federal, State and local governments over keeping or opening up plants in their areas. The NYTimes has documented how major Job Creators continue to insist on reduced state and local taxes in a trade for jobs. The report details how broad these efforts are:

A NYTimes investigation has examined and tallied thousands of local incentives granted nationwide and has found that states, counties and cities are giving up more than $80 billion each year to companies. The beneficiaries come from virtually every corner of the corporate world, encompassing oil and coal conglomerates, technology and entertainment companies, banks and big-box retail chains.

The cost of the awards is certainly far higher. A full accounting, The Times discovered, is not possible because the incentives are granted by thousands of government agencies and officials, and many do not know the value of all their awards. Nor do they know if the money was worth it because they rarely track how many jobs are created. Even where officials do track incentives, they acknowledge that it is impossible to know whether the jobs would have been created without the aid.

So in effect Job Creators are truly taking advantage of their role even though many of their initiatives are more job preservation than new job creation . And in many cases Job Creation is at lower pay and benefits. This is not good even for the the Job Creators. In a country that has thrived on a large and prosperous middle class with 70%++ of the economy dependent on Consumer Consumption, this might well be considered a case of the Job Creators killing the golden goose of well paying jobs.

US Job Creators Against Worldwide Competition

So with this cautious investment strategy of US Job Creators, it should be no surprise that the US continues to see a decline in the number of companies in the Fortune Global 500. It reached a peak in 2002 with 197 companies but has declined to 132 in 2012. However the steepness of the decline has abated somewhat as the US lost only 1 firm from the list of Fortune 500 largest global firms in 2012. Meanwhile, Chinese firms continue to join the top ranks at a fast pace with 10 new entrants in 2012 to a total of 79. So perhaps US Job Creators, having been excessively cautious, will seize on new market opportunities.

Perhaps more intangible is the measure of innovation. In the hotly contested area of electronic device, Asian firms such as HTC, Lenovo, Asus, Acer and ntably Samsung have taken awaymarket share from such US Job Creators as Google/Motorola, Dell, HP, and even Apple. And in pharmaceuticals field the European and Israeli firms lile Novartis, Roche, Teva, and GlaxoSKF lead the way over their US Job Creator particularly in the arena of bio-pharmceutics. So in a world of globalization, US Job Creators no longer have a leg up of the largest domestic market[okay the crossover with China becoming largest will be 2015-2016], but still do have a military education complex churning out innovations, innovators and their engineers in numbers.

US Job Creators Working Hard to Turn the Business Climate Around

Given the US Job Creators continuing loss of global business stature, they are actively working to change their position. They are doing so in three ways. First,Job Creators are supporting Think Tanks where broad technical and social trends are monitored and effective policy can be discussed and organized. Think Tanks are major economic policy and international government and business strategy formulators:

Number of Think Tanks peaked in the Clinton/PC/Internet Era

Think Tank’s ability to describe the pace of change and help formulate policy for the new normals were highly valued. The need to establish economic and technical policies for such phenomena as globalization of business and trade, rapid techology-spurred change, emergence of developing economies, and handling global problems of climate change, spreading pollutions, and resource depletion – all of these contributed to the growth of Think Tanks.

But since 2000, Think Tank funding and operations have changed as outlined in this 2012 report from the University of Pennsylvannia:

National, regional, and local governments have cut their funding for public policy research while corporations and private

foundations have limited their grant-making to project-specific support. Foreign donors from Asia, and the oil-rich countries of the Middle East increasingly help fill the funding gap … This can be a mixed blessing since these donors often have very specialized interests and want to be involved in the projects they support on an ongoing basis. In addition, some private foundations and individual donors have been moving

their support away from analysis to activism and from think tanks to advocacy organizations…The vast majority of the think tanks that have come into existence in the last 30 years have been focused on a single issue or area of policy research. More recently, think tanks have faced a new competitive threat from consulting firms, law firms, advocacy groups and cable news networks that now directly compete with think tanks for gifts, grants and contracts….

The rise of special interests and a need for a quick response to complex policy problems have created a greater demand for policy research and fostered the growth of specialized public policy think tanks. This trend has placed greater emphasis on marketing strategies and external relations that effectively target key constituencies and donors…

[As a result] some think tanks appear to be losing their voice and independence along the way. Managing the tensions associated with relevance, influence and independence is a delicate balancing act that must be carefully managed if think tanks are to maintain their credibility with policymakers and the public.

In effect, the two trends of specialization and advocacy have meant that some of the key characteristics of traditional Think Tanks such as transparency political independence and scientific rigor have been sacrificed for advocacy This article describes how Job Creators have used “think tanks” for their specialized and sometimes clandestine puposes:

In some cases, corporate interests have found it useful to create “think tanks.” For example, The Advancement of Sound Science Coalition was formed in the mid-1990s to dispute research finding an association between second-hand smoke and cancer.[21] According to an internal memorandum from Philip Morris Companies referring to the United States Environmental Protection Agency (EPA), “the credibility of the EPA is defeatable, but not on the basis of ETS (environmental tobacco smoke) alone. It must be part of a larger mosaic that concentrates all the EPA’s enemies against it at one time.”[22]

According to the progressive non-government organization Fair.org, right-wing policy institutes are often quoted and rarely identified as such. The result is that think tank “experts” are allegedly sometimes depicted as neutral sources without any ideological predispositions when, in fact, they represent a particular perspective.[23]

In sum, once respected Think Tanks have been created or captured by strident advocacy groups [including major Job Creators] for their partisan agendas thus discrediting the Think Tank brand for its now questioned open, transparent, non-partisan, scientific and unbiased findings. This is the central argument of the book Merchants of Doubt

– where Job Creators and others have used clandestine methods to discredit legitimate social and scientific findings.A more direct way to turn government policy in your favor is just to pay for it. This is the method of lobbying and political campaign contributions which the Job Creators are using much more often.

Lobbying spending has more than doubled in the past 25 years

Lobbying is more effective than ever before because a)the Supreme Court has said it is part of Corporate Free Speech with few limitations, b)as logrolling has declined because of more virulent partisanship while campaign funding needs have ballooned lobbying become more influential as Job Creators financial wherwithal is more valuable and c)as legislation is passed incomplete [think Dodd Frank financial regulations], secret backroom committees become the point of “public” influence in a legislation’s final finishings. Hence it is no surprise to see the Job Creators as the major spenders in lobbying with such Job Creators as Exxon Mobil, General Electric and Northrop Grumman as leading spending. Note for later reference the massive spending of the Chamber of Commerce in the above table.

The second way to change the game is to get “your side” elected:

The Job Creators have turned [or remained] largely Republican

The above chart shows the leanings of various key business sectors. But it is important to note that the numbers do not add up 100% because not all contributions are subject to disclosure. But the key to note here is that GOP is in the Jobs Creators corner. Of even greater impact is the fact that the Chamber of Commerce is a)the biggest lobbyist by a factor of over 3 to 1 than any other business group and b) the Chamber of Commerce has become an overwhelming GOP supporter after years of being neutral and bipartisan. In recent years, some major Chamber of Commerce members have left finding the organization out of step with their wishes to be less partisan. But still the Chambern commands a $300miliion++ budget and has spent over $33 million in the 2012 campaign cycle the majority of which went to GOP candidates.

So politically and through specialized think tanks, US Job Creators are actively trying to shape US economic and political policy. They are strongly supporting the GOP even though the Republicans are a)responsible for more than 70% of the current US Deficit problem and b)the GOP is adamantly opposing infrastructure and other job revival programs that have in the past proven very effective in revitalizing an ailing economy .This in turn would help accelerate economic growth and business for the Job Creators. But the Jobs Creators agents, the GOP, have a different agenda and ability to effectively ignore their Job Creator sponsors[but mind you, the Job Creators hardly speak with any consensus on the issue of infrastructure and other government spending]. Hence continued economic obstructionism by the GOP prevails despite the fact that a) it is unnecessary and b) does not benefit the Job Creators firms . The GOP tail is wagging the Job Creator dog.

But here is another cautionary tale on how US Job Creators would like to change their political positions but cannot do so. Major US Job Creators would like to modify their stance on climate change but find themselves hopelessly entangled with the Chamber of Commerce, GOP policy, and other putative spokespeople. In sum, US Job Creators find themselves hopelessly entangled in contradictory alliances and allegiances which frustrate their freedom to act strategically.

US Job Creators Problems with Management And Governance

The major US Banks are the poster children of problems of management and governance in large US Job Creators. The largest banks have become not just Too Big To Fail

, Too Big To Jail, but also Too Big To Manage. But it is not the first time that Too Big To Manage has done in a major US Job Creator. Tyco International and ITT are case studies in Too Big To Manage corporate dissolution.Simply put, managing 3 or more disparate product/service divisions has become ever more challenging in the face of rapid social, economic and technical change. Just look at the rapid rise and fall of RIM and Nokia in the mobile arena. But equally challenging is the often antiquarian business governance that is associated with many US Job Creators. A timely article on the HP Board in the NYTimes shows how difficult it is to change a board even after several years of poor performance and high executive turnover. And even more damning, broader shareholder, employee and stakeholder issues are often barely on the HP Boards radar.

Nobel Prize winning Economist Kenneth Arrow posited that so much of Business and Economic success depends on Trust. But an ever broader expanse of US Job Creators are drawing down their stores of Trust. Look no further than the banks and their frontal assault on Fiduciary Trust and Customer goodwill. Consider major US manufacturers and their constant war on employees’ wages and benefits when the real villain in the piece is China and other outsourcing countries with artificially low rates of exchange. Or major auto firms or appliance manufacturers depleting Brand Trust by denying warranty claims and then having to do major recalls later on the very same issue. To say that governance is all about managing your various stakeholders confidence in your corporate trusts – then US Job Creators have a major problem in their Trust Management especially in this Internet Age of instant all-knowing for those who care to seek and find.

Summary

So how are the US Job Creators Doing? Well as noted at the outset, ostensibly well by their own measures. Profits are up, wage costs are down and top management’s pay is going up, up and away again. But I have deliberately chosen to use the Republican WormTongue Frank Luntz [1] phrase” Job Creator”. The term is used throughout this post because it illustrates well the ambiguity and duplicity embraced by US Corporations and their management elites.

These are the CEOs and their trusted circles that are currently taking 325 times[2] the average pay of the workers they increasingly depend on. These are the management elites that pledge allegiance to the forces of The Market and then work triple overtime to insure those Market Forces do not apply to them and their compensation and leadership duration. Now not all CEOs do the latter two things at once. And some do neither. But given the Imperial Rules of Corporate Governance, there is indeed a corporate elite that have great sway over the US Economy and are barely answerable for their actual performance.

But perhaps the most damaging action by the Job Creators is to invest in the GOP and the defeat of President Barack Obama. Who knows what the Job Creators were looking forward to? Eight more years of President George Bush-like lax enforcement, reduced taxes, and regulations of their choosing? Even Forbes finds this misguided because the Stock markets have performed notably better during Democratic Presidencies. So now the Job Creators have organizations like the Chamber of Commerce and the GOP and particularly its rabid right Tea Party wing, dictating their strategy on infrastructure spending and climate change among other areas. Not so smart.

But these positions in turn have consequences for the Job Creators. Their US operations are now falling woefully behind Europe and Asia in infrastructure from education [15th in the World and falling on many measures], to transportation/public physical plant[ASCE-American Society of Civil Engineers give the US a D+ rating on infrastructure] to well trained employees or job candidates matching business needs. But perhaps the most telling consequence is that US Consumers are responsible for 70% of GDP in the past now do not have the enough income to drive domestic consumption. So is it a wonder that US Job Creators are losing their World Business leadership to others? So forget the US Economy and Consumers – tell me again – how are US Job Creators doing?

Footnotes

[1] In Frank Luntz own words, his speciality is “testing language and finding words that will help his clients sell their product or turn public opinion on an issue or a candidate.” See here for another example of Frank Luntz at work.

[2] The business theory of Six Sigma says at level 6, a business decisionmaker will be wrong 3 times in 10,000 decisions. But with a salary 325 times greater than the average worker, CEO decisionmakers should be at Sigma level 18 which would make CEO decisionmakers effectively infallible. Now CEOs may very well regard themselves as infallible. But as in the case of JPMorgan CEO Jamie Dimon reality intercedes and finds his decisions to be $10billion on the wrong side of infallibility.