Frank Bruni at the NYTimes raised 5 questions about telling issues in the Hillary Clinton and Bernie Sanders debate in Brooklyn last night. As the GOP is hacking itself apart in a grisly dismemberment over who controls the perverse loyalties of its Base, Bruni notes that the Democrats face fundamental schisms of their own. Specifically, Bruni cites the major tensions:

“The surreal twists of the Republican race and its domination by two politicians whom most party traditionalists find odious have obscured the trouble that the Democratic Party is in, by which I mean the strained, increasingly fragile alliance of the idealistic progressives whom Sanders has emboldened and the pragmatic technocrats who, with the help of both Clintons, have defined Democratic politics for the last few decades.

The hostility that so many of Sanders’s supporters feel toward Clinton is a rejection of that kind of politics, and that hostility is where the fiercest energy in the party resides right now. It was audible on Thursday night, in the boos from the audience that sometimes rained down on Clinton.

And this would be generating more discussion — and more angst — if not for the G.O.P.’s implosion and the belief that the Republican nominee will likely be a fatally hobbled one.

But beyond and outside of the 2016 presidential election, Democrats have plenty of soul-searching and fence mending to do. The party must examine the firmness of its hold on young voters: If they alone were deciding the Democratic nominee, it would be Sanders in a walk.

The party needs to figure out its relationship with corporate America, long friendly to Clinton and now demonized by Sanders. It needs to assess its appetite for foreign interventions, a subject on which Sanders and Clinton differ sharply, as they demonstrated afresh on Thursday night.

There are profound policy differences between the candidates, and there’s a chasm between those Democrats who think that paradigm-exploding change is necessary (and possible) and those who roll their eyes at that, deeming it naïve and delusional.”

This clash of policies is underlined by the question of Wall Street Money taken in by both Hillary Clinton and Barack Obama. Sanders keeps asking over and over how can Hillary be serious about campaign finance reform and rolling back the Citizens United decision that identifies corporations as equivalent to individuals when those very same corporates [particularly Wall Street] are major campaign contributors . Those corporations will be loathe to lose the ability to spend millions of free speech dollars on lobbying and campaign finance contributions without having to get any approval from the corporations employees, stakeholders, suppliers and customers. Literally, free speech corporates speak with one elite voice.

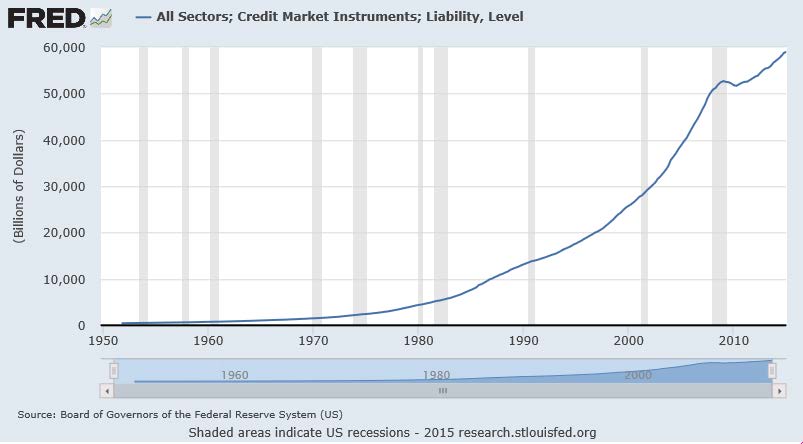

Likewise, as the US teeters with huge Federal Reserve inflated national debt and continuing huge $1/2 trillion balance of payment shortfalls, the total US Debt continues to climb to unprecedented levels:

The risk of too big to fail financial institutions has not diminished but increased since 2008 despite the Dodd-Frank Law and protests of too much regulation and oversight by many financial institutions. For example, 5 US banks hold 95% of the $250trillion in dervative obligations in financial market. That is nearly 4 times the World GDP. It is these complex derivative instruments plus the accumulation of 50% of all banking assets in 7 US Banks that created the financial gridlock that only the US government could bail out at huge cost to US taxpayers and Homeowners.

And even worse, the government’s ability to monitor “too big to fail” financial institutions is currently being held up in protracted court cases. This becomes the crux of the Sander’s argument, by accepting huge campaign contributions from the Financial community, Hillary Clinton has lost her ability to monitor, prosecute and control that financial community which is lobbying mightily to rollback any controls on their activities. As Bruni points out that is when Hillary Clinton runs for cover, hiding behind Barack Obama:

‘Why shouldn’t voters be troubled by her Wall Street money? She noted that President Obama had done precisely the same kind of fund-raising, and that any insinuation that it was inherently corrupting meant that he too had been corrupted.“This is not just an attack on me,” she said. “It’s an attack on President Obama.”’

Indeed it is a facing up to the Obama Flaw.

The Obama Flaw

It is widely noted that Barack Obama got first 20% of his campaign funding in 2008 and then 33% of his 2012 campaign funds from the financial sector. Did those contributions influence Barack Obama’s administration. You decide considering that except for Bernie Madoff no financial executive went to jail for stream of financial misdeeds that started in 2006 and continue to the present day. In contrast, for the Savings and Loans crisis of 1980 to 1996 which cost taxpayer $130Billion over 1000 bankers were prosecuted and went to jail. For 6 times that amount of tax payer cost for the 2007-2009 Financial Crisis, nobody on Wall Street went to jail under Attorney General Eric Holder. Prior to joining the Obama team , Eric Holder who had work defending banks at Covington Burling law firm from 2001 to 2007. He has returned to Covington Burling in 2015.

“This law firm’s clients have included many of the large banks Holder declined to prosecute for their alleged role in the financial crisis. Matt Taibbi of Rolling Stone opined about the move, ‘I think this is probably the single biggest example of the revolving door that we’ve ever had.'”

Seth Meyers of SNL fame took a Closer Look at the Obama Administration prosecution of financial executives:

https://www.youtube.com/watch?v=zWdZPG4iGyQ

The NYTimes found a similar pattern of “kid glove” treatment for white collar and financial criminal activities. Now ex-AG Eric Holder and other of his prosecutors have argued that a)the Bush Administration had left large gaps in financial investigatory work, b)the financial executive suite could not afford prosecutions during the crisis, and c)the complex evidence chain and lack of clear legal prohibitions made for difficult prosecutions.

But the bottom line is that under the Obama Administration Rule of Law has not applied to Wall Street Financial Institutions and their executive suite. Was this “quid pro quo” for 1/5 and then 1/3 of Barack Obama’s campaign funding coming from Wall Street? More likely than perhaps. If Hillary Clinton wins the Democratic nomination and subsequent Presidency the hypotheses will get tested again. Some have argued that Mitch McConnell & the Tea Party cabal that plotted the scorched-earth NO Compromise with Obama did so because Obama had invaded the GOP Wall Street funding turf and this was one more motive to tarnish the President. Others have posited that when President Obama failed to prosecute both Bush Administration officials for WMD falsehoods and Wall Street Financial Rating Firms for their blatantly fraudulent Mortgage Debt ratings – the jigs was up. Obama was no agent of change – rather, as calculatingly flawed as they are.