The following post from John Mauldin Economics hit my inbox by way of an MBA buddy. The almost palpable angst and uneasiness of the post is worth examining in more detail. Here is a capsule summary of the article which can be seen in its entirety here.

Central Banks and the Rise of Extremism

John Mauldin | May 11, 2016

Do you feel as if you’re the rope in a tug of war? That’s the closest analogy I can come up with to describe what’s going on inside my own head – and in the world. And at the last few conferences where I’ve spoken, talking with the participants afterwards, I’ve found that my feeling is widely shared. Our sense of direction, the sense of knowing where we’re going, is gone. To analogize some more, I told a friend last night that I feel as if we have slipped our anchor and are adrift on the ocean on an overcast night. There’s no wind and we have only limited rations, so we need to start rowing, but we know that landfall in one direction would be impossible to reach, two other directions would be extremely problematic, and we might, just might, get lucky with the fourth. But how do we choose, with no North Star? Especially when our compass seems to be spinning!

And that’s what the constant onslaught of contrary data and the continual head-snap of political events, not to mention geopolitical events, is doing to our investment compasses. We keep tapping the glass, hoping the needle will settle down. How’s that working out for you?

I found some comfort in this week’s letter from my good friend Danielle DiMartino Booth. Her website, Money Strong, has a posting, “Central Banks and the Rise of Extremism,” which echoes some of my own thoughts…. her argument is succinct:

We’ve been told to look away from the mystery of the Fed. The assumption is that the best interests of the country are safeguarded by this enigmatic group of brilliant academics. But our very destiny hinges on resolving to understand how Fed policy allows our politicians to abdicate their commitment to make the hard decisions that keep the country on a sustainable path to prosperity.

Public pension systems at risk, unaffordable housing, malinvestment, rampant financial engineering by America’s companies, stagnant wages, skyrocketing student debt, millions who have dropped out of the labor force, chronic asset price bubbles. All of these ills lay at the feet of the Fed, which has essentially become the fourth, and most powerful, branch of the U.S. government.

I am not surprised by the malaise expressed Mr Mauldin and Mme Booth. “Debt is out of whack worldwide in countries on every continent” and this is giving rise to extremism throughout developed and developing countries. The irony is that the economic plight of ever wider percentages of the population is due to the the excessive trickle down tax breaks and easy money of the past 20-25 years. This appears to be a contradiction – with the World awash in ready cash how can so much income inequality and debilitating levels of underemployment persist throughout the world? A more parsimonious yet telling explanation is available.

Lets blame Technology – nothing more, nothing less.

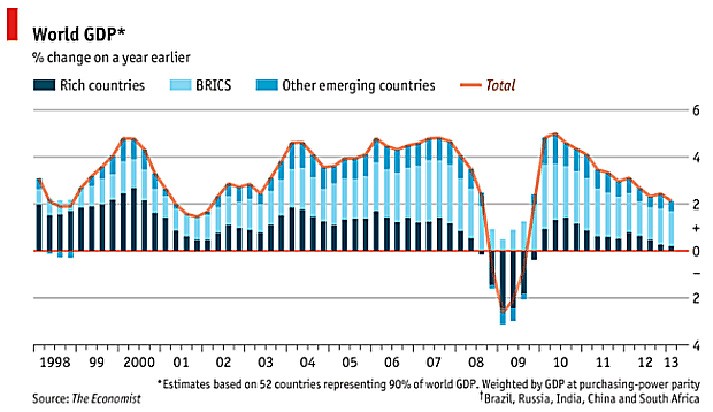

Technology has made instantaneous, cheap two-way communication available worldwide. To the traditional one-way, one privileged party of traditional media such as TV and radio overlay a vast and virtually free network of networks available in local languages anywhere in the world. So everybody that wants to can now know what is happening anywhere in the world. Anybody who wants to know how to do any deed can get the know how and buy the enabling technology anywhere in the world.This instant communication should promote expansion and development worldwide given ever more ready cash. The latest GDP growth rates are shrinking:

Worldwide easy money and fast communications should equal economic growth; but the last 5 years have seen a disturbing downward trend.

Technology has fostered asymmetrical warfare. Now getting horseshoe close to vulnerabilities is all that is needed to wreak havoc anywhere in the world. All you need is great gobs of economically hopeless youth, some basic explosive, incendiary, and/or electronic disruptive technology, get surprisingly close and you can get CNN headline mayhem anywhere in the world. And the cost is also asymmetrical forcing developed countries to spend over $500 billion in 2014 Homeland Security spending . Add those numbers to worldwide Defense Spending:

The total of $2.2trillion spending world wide is staggering.

Technology has automated out an ever wider array of jobs not just in manufacturing but also logistics and operational management. Couple this automation with developing countries offering work forces costing a fraction of the developed countries wages and voila with the touch of WTO, NAFTA and soon TPP great rust belts have not just appeared all over Europe, North America, and South America but also have become more endemic because the supporting trades, skills and industries have atrophied if not vanished. And for wide swaths of Africa, the Mideast, and Tropical Asia, the moats and barriers to entry in many manufacturing and logistical operations are nearly insurmountable leaving their workforces subject to high underemployment if not outright unemployment. This in turn provides ample supplies of disaffected populations and thus the manpower plus suicide fodder for the asymmetrical Terrorists like ISIS, Boko Haram, AlShebab, etc. Here is the map of Youth Unemployment Worldwide:

As one can see the Mediterranean basin is the hotspot for youth unemployment reaching 35% or higher in Spain, Italy, Greece, Syria, Palestine, Egypt, Libya, Tunisia, and Morocco.

Technology has provided the algorithms and cheap computing power necessary to create the bizzaro-betting worlds of dark money, opaque debt, and hundreds of $trillions locked in complex and risky derivative bets. The world of finance has barely paused post the 2007-2009 Financial Recession in enmeshing itself in financial betting of ever Gargantuan Dysproportions.

In 2014, just Short-term Interest Rate Derivatives had avalue of $1337 trillion [or 17 times larger than the World’s GDP] on 1.741 billion contracts sold. STIR derivatives are only one of 8 major derivatives types sold worldwide. See details here.

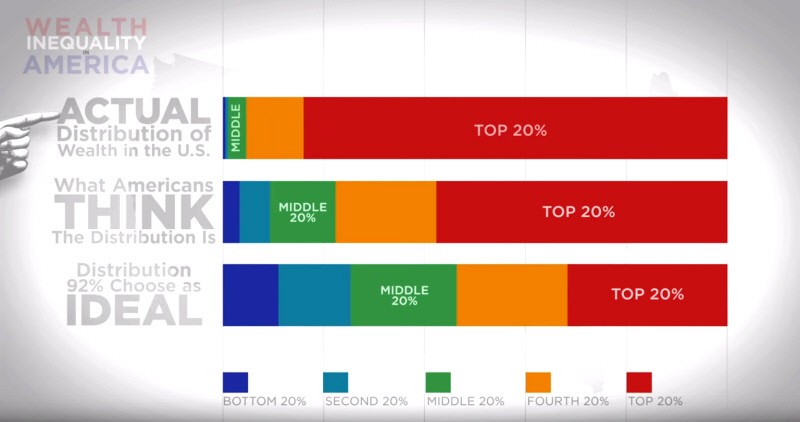

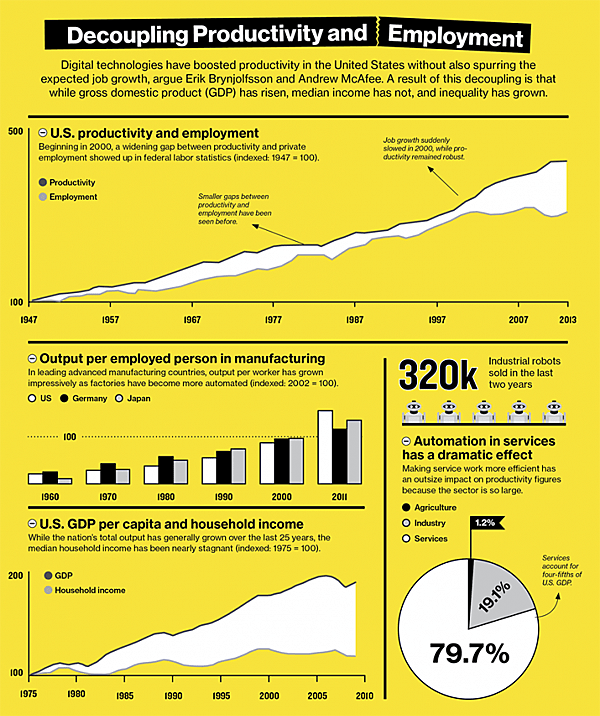

Technology is providing a third wave of AI Automation that will wipe out another huge swath of white collar and operational jobs. This is a world-wide wicked problem making climate change look trivial. The reason is simple. The promise of the New York’s 1964 World’s Fair was a 15 hour work week with middle class well being for all. The reality across all countries is collapsing middle class and growing in-roads on the 1% and 5%-ers with AI automation. So how can can developed economies which are dependent upon Consumer Consumption for 70% of their GDP and economic well being hope to prosper when the Golden Goose, a prosperous Middle Class, is rapidly dwindling. And of course, wealth and income inequality are not isolated to the developed countries but also are being seen in neo-developing countries like the BRIC works.MIT Technology Review describes the phenomenon:

In an update article, MIT Technology Review describes how pervasive the 3rd Wave of AI automation will be and its drastic effects on employment.

Technology is clearly responsible for gutting the Middle Class worldwide while setting up relative Meccas of prosperity and stability, especially in Europe, that are attracting refugees from the other great World Social Rift – the rampant and grizzly clashes of centuries old religions.

But far be it for me to suggest that Business elites are taking more than their fair share of income and wealth. Far be it for me to suggest that Business is taking huge dollops of Corporate Welfare payments in the forms of subsidies and tax breaks. Far be it for me to cite CEOs for now taking 373 times the average wage in their organizations while the rest of the corporate team have seen their wages and benefits stagnate for 30 years. Far be it for me to suggest that Businesses and the 1-to-5%-ers are paying historically low fractions of their wealth and income in taxes. So city, state and national debt as % of GDP are rising as Mauldin and Booth have so thoughtfully pointed out. And as for Household debt rising – with incomes stagnant but costs for health, education and food stuffs rising it is inevitable.

Again far be it for me to suggest that politicians are being bought out – especially with no limits on campaign finances or outright bribery alive and well in USA, Russia, Venezuela, Nigeria, and a host of failed states. In the US in particular, the Rule of Law no longer applies to the executive elites in Finance and Wall Street as evidenced by the fact that in the Savings and Loans failures of 25 years ago many executives went to jail and/or were barred from financial practice. In contrast for the Housing Bubble of 2007-2009 and an ongoing series of flagrant tax dodging, Libor rate fixing, Robo-mortgage signing, huge money laundering cases,etcetera have left the financial community criminally untouched in the US. And so Rule of Law which is essential in the Financial industry does not apply to its executive elites. This defiance of the Rule of Law is increeping throughout corporate executive suites.

So far be it for me to suggest that the Malaise in the Investment Community expressed by Mauldin and Booth are due to anything but Despotic Technology. Get that under control and who is afraid of a half dozen Black Swans or even an ever rising Worldwide Plutocracy??