NYTimes Dealbook has a story today that the DOJ-Department of Justice is finally going to get tough with the Big Banks. “Getting tough” means no more “largest financial fine history but no admission of guilt by the financial institution – i.e. off the criminal action hook. Unfortunately, 5years into the financial crisis this is a case of not closing the barn door but saying that we are attempting to close the door after the horses, cattle, and even the stray cat have already gotten out. And as you read the NYTimes report, it becomes evident that DOJ is hedging its bets on getting any serious financial criminal prosecutions.

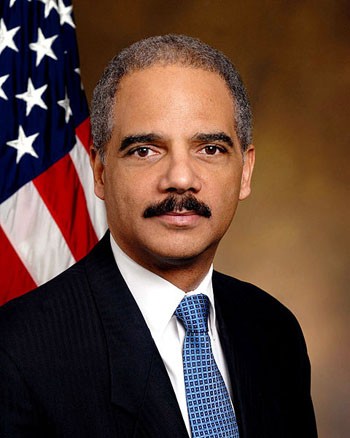

Far be it for this blog to say that Attorney General Eric Holder, previously a very well paid defender of the Big Banks, and the DOJ have slipped in proescuting large, primarily American financial institutions. Rather, I will let the following observers of the financial scene add their comments.

First, the Wall Street Journal state the case made by the DOJ up until know:

A former top U.S. official in charge of investigating the financial crisis said the government has concluded that many inquiries of wrongdoing by financial executives can’t succeed as criminal prosecutions.

“There’s been a realization and a more deliberate targeting by the Department of Justice before we launch criminally on some of these cases” said David Cardona, who was a deputy assistant director at the Federal Bureau of Investigation until he left last month for a job at the Securities and Exchange Commission. The Justice Department has decided it is “better left to regulators” to take civil-enforcement action on those cases, he said.

Forbes on Feb 4 of this year shows how civil not criminal charges and a scatter-gun approach remains from DOJ

There’s news today that the U.S. Justice Department is preparing to file civil charges against Standard & Poor’s Rating Services over the way it rated mortgage bonds before the crisis. S&P says the suit, which has yet to be filed, is without merit.

On the surface, going after a credit rating agency for its role in the crisis is not surprising. Credit rating agencies were giving top-notch ratings to what were essentially toxic assets that banks would then turn around and sell to investors. Credit ratings agencies were dubbed “key enablers of the financial meltdown” by the U.S. Financial Crisis Inquiry Commission 2011. So, yes, it’s the Justice Department’s job to seek out those who caused the financial crisis. Why then is S&P the only firm the Department is going after in its quest to prosecute those responsible for the financial crisis? Many firms were responsible for the financial crisis and not one of them is being charged.

In December, Bloomberg raises the issue of criminal prosecutions:

Senior U.S. lawmakers from both parties are seeking more criminal prosecutions for executives tied to financial-industry wrongdoing as the government reaches billion-dollar settlements with UBS AG (UBSN) and HSBC Holdings Plc. (HSBA)

Representative Barney Frank, a Massachusetts Democrat and co-writer of the 2010 regulation overhaul that bears his name, said in a letter to U.S. Attorney General Eric Holder this week that the Justice Department must increase prosecution of individuals to ensure the “integrity of our financial system.”

Matt Taibi of Rolling Stone in his own post Too Big to Jail and then on the Bill Moyers Show:

:Well, the HSBC settlement was a really shocking kind of new low in the history of the too big to fail issue. HSBC was a serial offender on the money laundering score. They had been twice given formal cease and desist orders by the government. One dating back as far as 2003, another one in 2010 for inadequately policing the accounts in their system. They laundered over $800 million for cartels in Colombia.

Drug cartels in Colombia and Mexico. They laundered money for terrorist connected banks in the Middle East. Russian gangsters. Literally, you know, I talked to one prosecutor who’s, like, “They broke basically every law in the book and they did business with every kind of criminal you can possibly imagine. And they got a complete and total walk.” I mean, they had to pay a fine[$1.9B]

It’s a lot of money. But it’s five weeks of revenue for the bank, to put that in perspective. And no individual had to suffer any consequences at all. There were no criminal charges no individual fines, which was incredible. Incredible.

But Felix Salmon at Reuters urges caution when prosecuting the banksters. Here is the classic delineation of too big to prosecute.

Justice, then, needs to ask itself what exactly it’s trying to achieve with these criminal admissions. In principle, I’m all in favor of holding criminal organizations to account for their actions. But only if doing so does more good than harm

Columbia Journalism Review summarizes the state of affairs in January of this year.

We’d be remiss to not flag Frontline’s outstanding investigation into the shameful failure of the Obama administration to pursue, much less prosecute, Wall Street for financial crisis fraud.

Frontline’s Martin Smith just nails Breuer, and by extension, his boss Eric Holder and Obama for their baffling failure to indict anyone on Wall Street for financial crisis fraud.

It’s hard to remember now, but there was a point when it seemed likely that financial-crisis prosecutions would make the S&L scandal look minor. Recall back in March 2009 when The New York Times reported that “Spurred by rising public anger, federal and state investigators are preparing for a surge of prosecutions of financial fraud.”

Within a year and a half of that story, even Andrew Ross Sorkin was sneering at Holder and the DOJ about the lack of prosecutions.

Since then, no Wall Street executive has been indicted or prosecuted for the crisis.

Ye Editor would add the following based on Felix Salmon argument that many financial institutions and their Boards and other top executives by implication are too big to criminally prosecute. Simon Johnson would also add too big to manage successfully. Does not this add up to 3 strikes against the big banks and other monopoly financial institutions:

1) too big to fail means taxpayers pickup the “no-failure” tab costing $tillions;

2) too big to criminally prosecute means that tier financail executives are immune f to the rule of law;

3) too big to handle/manage means the risk of another finacial debacle is a lot higher than anyone on either side of the Congressional aisle cares to admit.

So don’t these conditions state the case clearly for splitting up the big banks and financial companies as was done with the oil companies at the turn of the twentioeth century?