Mitt Romney now appears to be the leader to beat in the polls for the next 3 primary votes – New Hampshire, South Carolina and Florida. In the Saturday ABC Debate debates the consensus is that Romney escaped unscathed as none of his rivals attacked him even with comparison statements. The result is that the Sunday debate on NBC was more pugnacious and there is more to come. TheDaily Beast is reporting that the Huntsman Pac was outbid by the Gingrich PAC for the rights to the following video, King of Bain. This 30 minute expose shows how “Mitt Romney knows business” as head of Wall Street-imitating LBO-Leveraged Buy Out firm Bain Capital.

Now Mitt Romney will have to stand up to scrutiny for being a very rich 1 percenter taking advantage of the other 99% by eliminating jobs and funneling money to his Wall Street investors and partners. Vanity Fair also writes about this issue:

For 15 years, Romney had been in the business of creative destruction and wealth creation. But what about his claims of job creation? Though Bain Capital surely helped expand some companies that had created jobs, the layoffs and closures at other firms would lead Romney’s political opponents to say that he had amassed a fortune in part by putting people out of work. The lucrative deals that made Romney wealthy could exact a cost. Maximizing financial return to investors could mean slashing jobs, closing plants, and moving production overseas. It could also mean clashing with union workers, serving on the board of a company that ran afoul of federal laws, and loading up already struggling companies with debt.

There is a difference between companies run by buyout firms and those rooted in their communities, according to Ross Gittell, a professor at the University of New Hampshire’s Whittemore School of Business and Economics. When it comes to buyout firms, he said, “the objective is: Make money for investors. It’s not to maximize jobs.” Romney, in fact, had a fiduciary duty to investors to make as much money as possible. Sometimes everything worked out perfectly; a change in strategy might lead to cost savings and higher profits, and Bain cashed in. Sometimes jobs were lost, and Bain cashed in or lost part or all of its investment. In the end, Romney’s winners outweighed his losers on the Bain balance sheet. Marc Wolpow, a former Bain partner who worked with Romney on many deals, said the discussion at buyout companies typically does not focus on whether jobs will be created. “It’s the opposite—what jobs we can cut.”

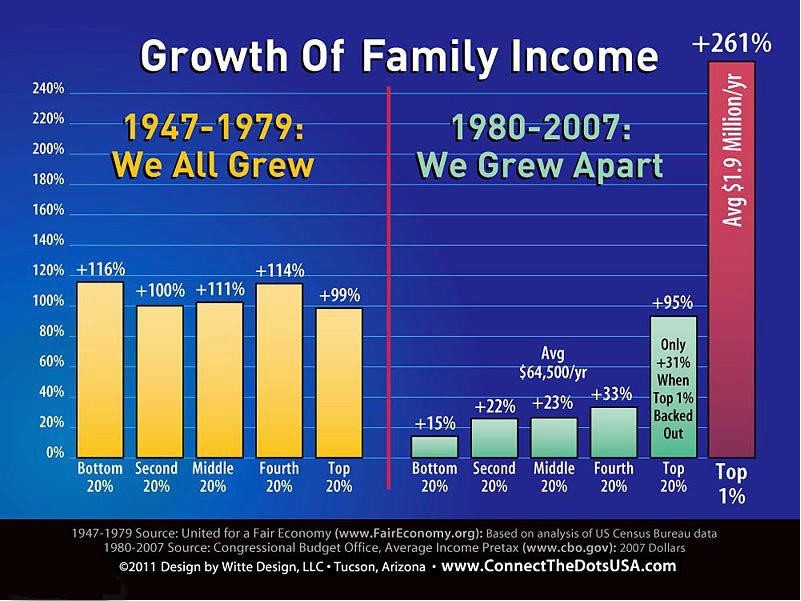

This is the crux of what has been killing middle class incomes in the US for the past 30 years. Too many US businesses like Bain Capital have been raiding the Income Commons by making concerted attacks on US working jobs with stagnant wages, relentless benefit reductions, work cutbacks and job outsourcing overseas. And the facts are indisputable, the beneficiaries of this Romney “I Know Business” policy is that the 1% like Mitt Romney have been the major winners over the past 30 years:

So before you buy Romney, know just how Romney Knows Business.